Blog

Analysis, discussions and concepts in the financial environment

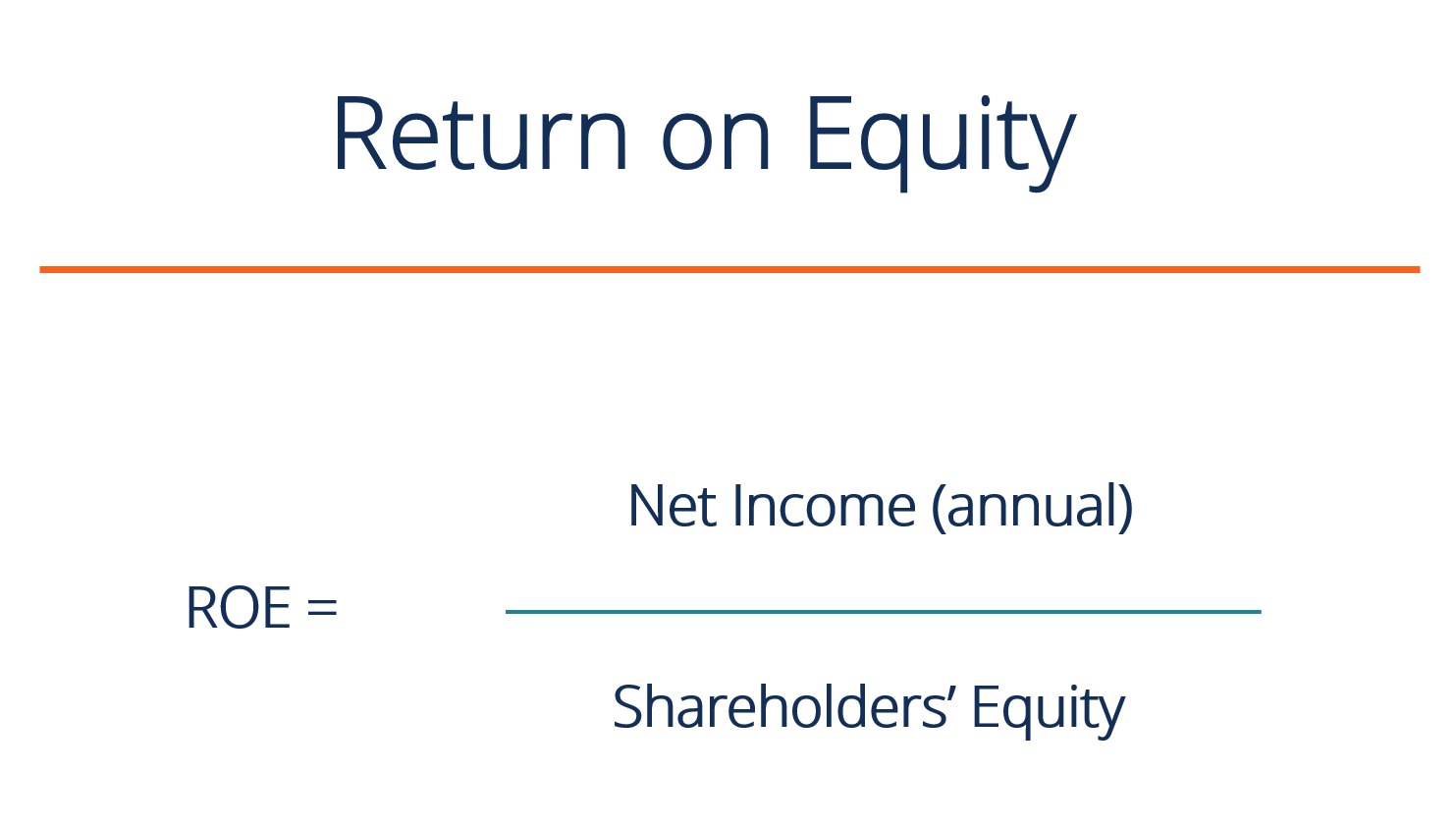

The importance of ROE (Return on Equity) in company valuation

ROE is an important valuation metric because it indicates how efficient the company is in the use of its capital. A company with a high ROE indicates …

How interest rate developments influence the credit market

Interest rate developments are a key factor influencing all financial markets, including the credit and 'distressed debt' markets. In this article, we …

Leverage: a double-edged sword for the investor

Leverage is a technique used by investors to increase the potential return on their investments. In simple terms, leverage means using borrowed funds …

Compound interest: the secret to growing your savings

Let's see what compound interest is and how it affects the exponential increase in value of one's investment portfolio over the years

Fear Greed Index: the indicator that reveals market sentiment

Today we look at this index that measures market sentiment and try to understand how it can be exploited in times of particular market turmoil

Investment strategies in the current economic environment: a challenge for investors with the help of ChatGPT (OpenAI)

Let's see how AI (Artificial Intelligence), in particular the famous ChatGPT by OpenAI, constructs a diversified investment portfolio across asset …

Tax Deduction vs. Tax Deduction: What is the Difference and How Best to Use Them?

Today we try to address the difference between these tedious but important terminologies, which can contribute to more savings and consequently more …

Pension funds in Italy: does it make sense? And what are the pros and cons

The importance of having a pension fund is a crucial issue for the financial stability of our future. In a country like Italy, where it is possible to …

Price/Earning (PE) and Price/Earning to Growth (PEG): how to use these financial indicators to make investment decisions

Let's look at these two financial indicators and how they can be used among the parameters to assess the goodness of a company for its investment …

Top 5 ETFs by Capitalization: A Comprehensive Review

In this paper, we will take a closer look at the first 5 ETFs for capitalization. These ETFs represent a diverse range of industries and sectors, and …

Jim Simons and his Renaissance Technologies fund

Today we find out about one of the best investors and his fund, which has been racking up killer results since the 1980s