Money-Weighted Rate of Return

Let's see how the money-weighted rate of return is defined and how it can be used to assess one's return on investment portfolios, especially in CAP (Capital Accumulation Plan) cases

Friday, 2 September 2022

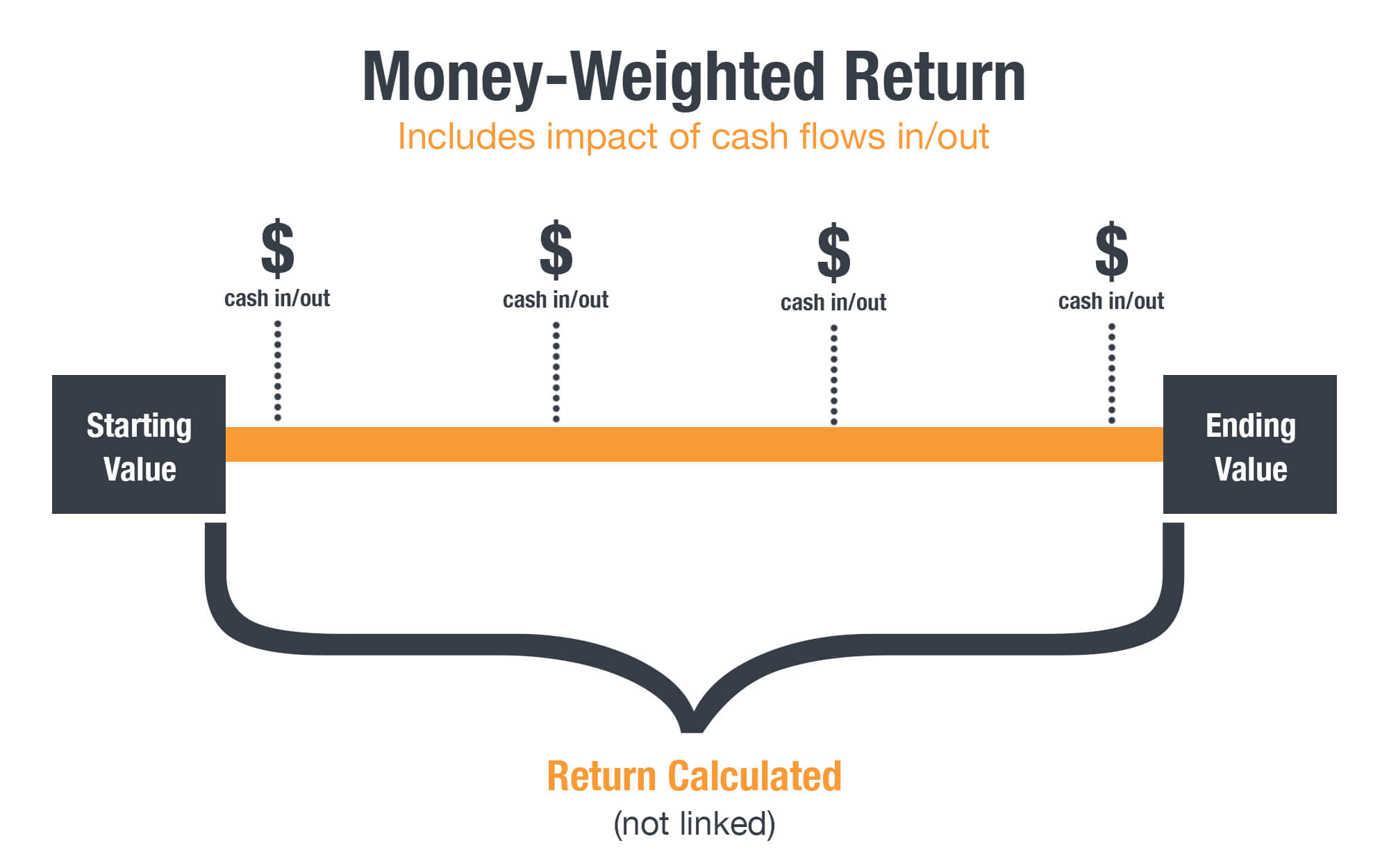

Money-weighted rate of return

What is the money-weighted rate of return? The money-weighted rate of return (MWRR) is a measure of the performance of an investment. The MWRR is calculated by finding the rate of return that sets the present value (PV) of all cash flows equal to the value of the initial investment.

The MWRR is equivalent to the internal rate of return (IRR). The MWRR can be compared with the time-weighted return (TWR), which eliminates the effects of cash inflows and outflows.

where:

- $PVO$ = outgoing PV

- $PVI$ = Incoming PV

- $CF_0$ = Initial cash outflow or investment

- $CF_1,CF_2,CF_3,\dots, CF_n$ = Cash flow

- $N$ = Each period

- $TIR$ = Initial rate of return

How to calculate the cash-weighted rate of return

To calculate the IRR using the formula, we set the net present value (NPV) equal to zero and solve for the discount rate (r), which is the IRR. However, due to the nature of the formula, the IRR cannot be calculated analytically and must be calculated by trial and error or by using software programmed to calculate the IRR.

Discover how easy it is to replicate this analysis and many other investment strategies in the Wallible app. With free registration you get access to all the tools.

Sign up for freeWhat does the weighted rate of return tell us?

There are many ways to measure asset returns and it is important to know which method is used when examining asset performance. The MWRR incorporates the magnitude and timing of cash flows and is therefore an effective measure of portfolio returns.

The MWRR states that the initial value of an investment is equal to future cash flows, such as added dividends, withdrawals, deposits and sales proceeds. In other words, the MWRR helps to determine the rate of return required from the initial investment amount, taking into account all changes in cash flows during the investment period, including sales proceeds.

Cash flows and money-weighted rate of return

As already mentioned, the MWRR of an investment is identical to the IRR. In other words, it is the discount rate at which the net present value (NPV) = 0, i.e. the present value of inflows = the present value of outflows.

It is important to identify the cash inflows and outflows from a portfolio, including the sale of the asset or investment. Some of the cash flows that an investor might have in a portfolio include:

Outflows

- The cost of any investment purchased

- Dividends or reinvested interest

- Withdrawals

Inflows

- The proceeds of any investment sold

- Dividends or interest received

- Contributions

The difference between the money-weighted rate of return and the time-weighted rate of return

The MWRR is often compared to the time-weighted rate of return (TWRR), but the two calculations have distinct differences. The TWRR is a measure of the compound growth rate of a portfolio. The TWRR is often used to compare the returns of investment managers because it eliminates the distorting effects on growth rates created by inflows and outflows of money.

It can be difficult to determine how much money has been earned by a portfolio because deposits and withdrawals distort the value of portfolio returns. Investors cannot simply subtract the beginning balance, after the initial deposit, from the ending balance, as the latter reflects both the rate of return on investments and any deposits or withdrawals during the period of investment in the fund.

The TWRR divides the performance of an investment portfolio into separate intervals, depending on whether money was added to or withdrawn from the fund. The MWRR differs because it takes into account investor behaviour through the impact of fund inflows and outflows on performance, but does not separate the intervals in which cash flows occurred, as the TWRR does. Therefore, cash outflows or inflows may have an impact on the MWRR. If there are no cash flows, both methods should give the same or similar results.

Limitations of using the cash-weighted rate of return

The MWRR considers all cash flows of the fund or contribution, including withdrawals. If an investment spans several quarters, for example, the MWRR gives more weight to the fund’s performance when it is higher, hence the name ‘money-weighted’.

The weighting can penalise fund managers because of cash flows over which they have no control. In other words, if an investor adds a large sum of money to a portfolio just before its performance increases, this is equivalent to a positive action. This is because the larger portfolio benefits more (in dollar terms) from the growth of the portfolio than if the contribution was not made.

On the other hand, if an investor withdraws funds from a portfolio shortly before a performance surge, this is equivalent to negative action. The now smaller fund benefits less (in dollar terms) from the portfolio growth than if the withdrawal had not taken place.

KEY RESULTS

- The money-weighted rate of return (MWRR) calculates the performance of an investment that takes into account the size and timing of deposits or withdrawals.

- The MWRR is calculated by finding the rate of return that sets the present values of all cash flows equal to the value of the initial investment.

- The MWRR is equivalent to the internal rate of return (IRR).

- The MWRR fixes the initial value of an investment so that it is equal to future cash flows, such as added dividends, withdrawals, deposits and sales proceeds.

Source: www.investopedia.com

Disclaimer

This article is not financial advice but an example based on studies, research and analysis conducted by our team.