The impact of the war on European economic recovery

Let's see what the European economic scenario might be following Russia's war against Ukraine

Friday, 24 June 2022

Key points

- Trade disruptions and inflation are weighing on businesses and households, threatening to derail the European recovery and push many citizens into poverty.

- The growth slowdown is particularly pronounced in Ukraine’s neighbouring countries, but other EU countries are also feeling the pressure.

- Public policies can help reduce the risks for vulnerable households and businesses, to keep poverty and closures at bay

The war in Ukraine threatens to undermine Europe’s economic recovery. Rising energy prices and trade disruptions could destabilise EU businesses, already weakened by the pandemic. At the same time, economic models of the European Investment Bank (EIB) show that rising inflation could push more Europeans below the poverty line. Real economic growth in the EU is expected to fall below 3 per cent in 2022, compared to the 4 per cent estimated by the European Commission before the war. A recession could occur and further trade disruptions or increased economic sanctions would increase the risk for the European economy.

These are some of the main findings of a new report entitled How bad is the Ukraine war for the European recovery? published today by the EIB. The new report analyses the economic shock caused by the war and the resulting impact on households, businesses, banks and governments.

The recovery of the EU economy from the impact of COVID-19 was still consolidating when the war broke out. Increased uncertainty and rising food, commodity and energy prices are affecting investment and sustainable and inclusive economic development," said EIB Vice-President Ricardo Mourinho Félix. “Maintaining good public policy coordination will be key to managing the economic impact of the war and will send a clear signal to the markets, reducing uncertainty and mitigating the risks of a new recession.” The EIB Group is ready to extend long-term financing at favourable rates to protect a green and sustainable recovery and support inclusive growth."

“Inflation and rising energy prices pose a new risk to EU businesses already weakened by the pandemic. Our models show that in one year the percentage of companies at risk of insolvency rises from 10% to 17%. In response, we need to implement clear policies to protect businesses and ensure that public investment is fully utilised to catalyse private investment,” said Debora Revoltella, EIB Chief Economist and author of the report.

To simulate and monitor your investment portfolio sign up for the free Wallible app

Sign up for freeIncreased risk of poverty: households will be affected differently from country to country and within countries

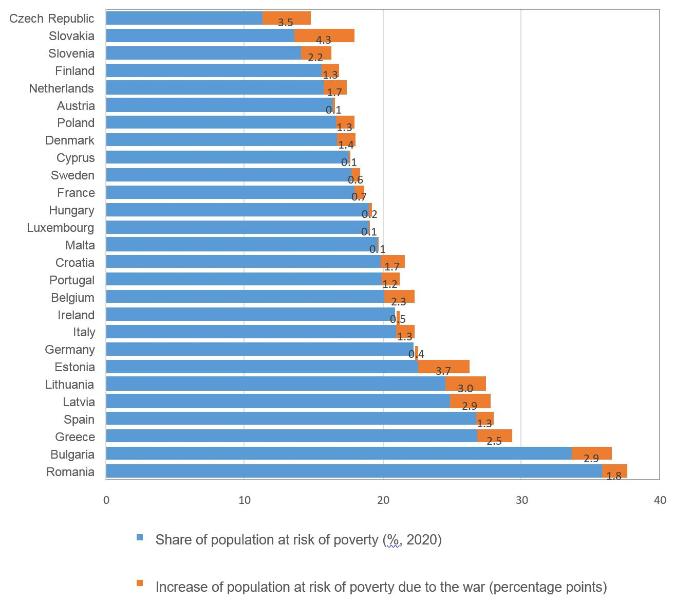

The inflation triggered by the war could reduce real private consumption in the European Union by 1.1%, although the impact will vary from country to country. The impact will be felt most in countries where consumption is most sensitive to energy and food prices and where a relatively large share of the population is at risk of poverty. Central and south-eastern European countries tend to be most affected.

Rising food and energy prices will disproportionately affect low-income households, but to different degrees in the various EU Member States. Low-income households in the richer countries of northern and western Europe are better able to absorb price increases than households in central and south-eastern Europe, mainly because savings rates and overall incomes tend to be higher.

Rising prices increase the share of people at risk of poverty (% of people at risk of poverty by 2020 and percentage point increase)

Source: EIB estimates. Note: The share of the population at risk of poverty refers to 2020 and is reported as a percentage. The increase due to war is reported in percentage points.

Source: EIB estimates. Note: The share of the population at risk of poverty refers to 2020 and is reported as a percentage. The increase due to war is reported in percentage points.

During the COVID-19 crisis, policy measures were crucial to keep poverty at bay. In the current crisis, policies must be used to reduce the risks for vulnerable households and maintain social inclusion.

The war environment poses new risks to EU companies

EU companies, especially smaller ones, were weakened during the COVID-19 crisis. Their ability to withstand the withdrawal of political support was already uncertain. The war will aggravate the vulnerability of companies through three channels:

a reduction in exports

reduced profits due to rising energy prices;

difficulty in raising finance as banks avoid the risk.

According to EIB company-level simulations, the proportion of loss-making companies will increase from 8% to 15% in one year and the proportion of companies at risk of insolvency will rise from 10% to 17% over the same period. The most affected sectors are chemicals and pharmaceuticals, transport and agribusiness. Companies in the countries closest to Ukraine and Russia, such as Hungary, Poland, Latvia and Lithuania, will feel the pressure. Companies in Greece, Croatia and Spain will also suffer more than the EU average.

Increase in the percentage of companies reporting losses (in percentage points)

Banks under pressure

The impact on banks is expected to remain limited, but companies’ access to external sources of financing may worsen. Overall, the European banking system has little direct exposure to Ukraine, Russia and Belarus, with the exception of a handful of banks. However, these banks have strengthened their capital buffers sufficiently to withstand the devaluation of some of their assets in Ukraine and Russia. Nevertheless, credit standards have started to tighten, especially in the Central, Eastern and South-Eastern European region.

The finances of EU Member States are likely to deteriorate.

Expenditure could increase due to the reception of refugees, the implementation of redistributive measures to help households cope with rising energy prices, and increased military spending. Revenues are also likely to be lower than expected, given the slowdown in economic activity, just as military spending is set to increase. In general, budgets are expected to be most affected in EU members bordering Ukraine and the Baltic States. Funds available from the Recovery and Resilience Instrument may give governments fiscal room for manoeuvre.

The European Investment Bank

The European Investment Bank (EIB) is the long-term lending institution of the European Union and is owned by the EU Member States. It provides long-term financing for sound investments in order to help achieve the EU’s policy objectives both within and outside Europe. The EIB operates in some 160 countries. It is one of the world’s largest multilateral providers of climate finance and recently announced that it will unlock and support EUR 1 trillion of investment in climate action and environmental sustainability in the decade to 2030. By 2025, at least 50 per cent of EIB financing will be earmarked for climate action and environmental sustainability. By the end of 2020, all EIB Group financing activities will be aligned with the objectives of the Paris Agreement.

Article source by www.eib.org

Disclaimer

This article is not financial advice but an example based on studies, research and analysis conducted by our team.