Comparison of the 5 most capitalized companies by sector in the S&P500

In this article we go over the performance, performance of a $1,000 investment, correlation and other statistics of the top 5 capitalized companies by sector in the S&P500 over the past 10 years: technology, healthcare, energy, consumer goods and finance

Wednesday, 30 March 2022

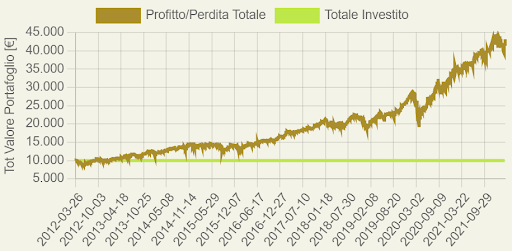

10000€ investment simulation over the last 10 years –> PIC simulator.

From the following graph and table we note that the maximum drawdown of the portfolio corresponds to the Covid-19 period, with the minimum of -32.96% touched on 23-03-2020. The final value after 10 years has more than quadrupled, with a performance of about 330%.

| Total Amount Invested | Final Portfolio Value | Profit | Volatility | Annualized Return | Maximum Drawdown |

|---|---|---|---|---|---|

| 10000€ | 43177.71€ | 331.78% | 17% | 17.6% | -32.96% on 2020-03-23 |

Discover how easy it is to replicate this analysis and many other investment strategies in the Wallible app. With free registration you get access to all the tools.

Sign up for freeBut who performed better among the 5? –> Comparator

Comparison analysis shows that over a 10-year period, Apple has clearly outperformed the other stocks by actually increasing its value tenfold, however, against more pronounced volatility. Volatility not to be underestimated for JPMorgan as well. Johnson & Johnson and Procter & Gamble had more linear growth while ExxonMobil “suffered” more than the other stocks.

| Asset | Performance (10 years) |

|---|---|

| Apple | 1012.6% |

| JPMorgan Chase | 391.75% |

| Johnson & Johnson | 336.76% |

| Procter & Gamble | 250.45% |

| ExxonMobil | 62.23% |

And from an ESG perspective, how is such a portfolio positioned?

The ESG tachometer positions the portfolio on an intermediate-high ESG risk level.

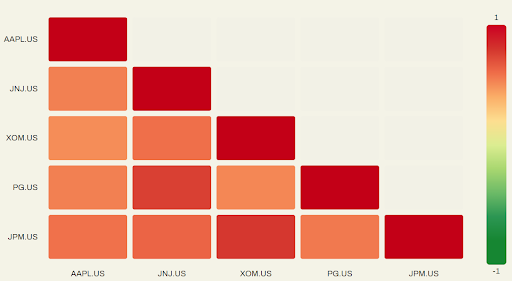

Securities correlation matrix –> Correlator.

The following correlation matrix shows that all stocks are positively correlated. The least correlated pair is Exxon/Apple which records a positive correlation of 0.31.

Conclusions.

The analysis was carried out on a portfolio in which the underlyings are equally weighted at 20 percent and are part of the same stock index: the S&P500. Despite the attractive returns achieved over the past 10 years, mainly driven by Apple stock, such a portfolio is poorly diversified and very volatile, having only a sector component as an element of diversification. The ESG profile of such a portfolio is at an intermediate-high level.

Disclaimer

This article is not financial advice but an example based on studies, research and analysis conducted by our team.