Performance comparison of different asset classes

This article examines the performance of different asset classes over the past 10 years: equities, government bonds, corporate bonds, gold

Wednesday, 16 March 2022

How much would I have made in 10 years investing € 10000 on an equally-weighted portfolio consisting of the major asset classes?

Let’s see with this analysis carried out on the following instruments:

- Equity: 25%

- Government bond: 25%

- Corporate bond: 25%.

- Gold: 25%

Investment simulation over the last 10 years –> PIC Simulator

From the following table we can see that the maximum drawdown of the portfolio corresponds to the Covid-19 period, with the minimum of -17.84% reached on 18-03-2020. The final value after 10 years has almost doubled, with a performance of around 90%.

| Total Amount Invested | Final Portfolio Value | Profit | Volatility | Annualised Return | Maximum Drawdown |

|---|---|---|---|---|---|

| 10000€ | 18885.54€ | 88.86% | 7.1% | 6.2% | -17.84% in data 2020-03-18 |

Discover how easy it is to replicate this analysis and many other investment strategies in the Wallible app. With free registration you get access to all the tools.

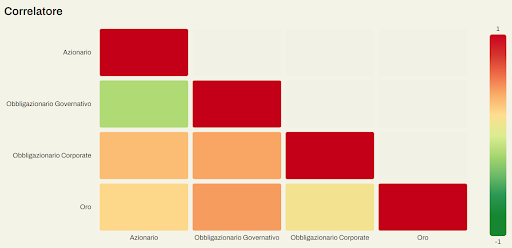

Sign up for freePercentage performance comparison –> Comparator

The comparison analysis shows how predictably over a 10-year period the equity component outperforms the other asset classes with the obvious disadvantage of higher volatility and higher drawdowns.

| Asset | Performance (10 years) |

|---|---|

| US Equity ETF | 331.27% |

| US 20-Year Government Bond ETF | 76.16% |

| US Corporate Bond ETF | 28.82%. |

| Gold ETF | 19.3% |